Unlocking Real Estate Investing: A Guide to REITs - Module 4

Individual REITs vs. REIT ETFs and REIT CEFs

Greetings, fam 👋

I welcome the new additions to our community!

Glad you’re here with us!

You can find the past modules at the end of this post.

🌟 REITs vs. REIT ETFs/CEFs

In module #3: “REITs vs. Private Real Estate,” we talked about why we prefer to invest in REITs over private real estate. REITs have outperformed private real estate with the added benefits of diversification, liquidity, professional management and cashflow. Now that we know the benefits and potential of REITs, the next question is how to invest in them. There are three options

Invest in a REIT ETF - ETFs are exchange-traded funds that invest in a diversified portfolio of real estate assets, allowing for diversification within the real estate sector without having to invest in individual REIT stocks or sectors.

Invest in REIT CEF - CEFs are closed-ended funds that also invest in a diversified basket of REITs. CEFs provide active management.

Invest in Individual REITs - This is an active approach of investing where the investor has to pick individual REITs and build their own portfolio, whether diversified or not.

For the “know-nothing investors, a good advice is to hold onto CEFs and ETFs. These approaches are great in diversification benefits. It’s also a passive approach, meaning you don’t have to do much on your end since management has everything under control so you’re saved from the hassle of having to buy/sell individual REITs. However, there are many limitations to ETFs and CEFs, in my opinion, which may hinder performance in the long run.

I prefer “Option #3: Invest in Individual REITs” because it allows us to target stronger risk-adjusted returns. Let us discuss all the flaws of REIT ETFs and CEFs and explain why investors should favor active approach to picking out individual REITs.

🚨 Flaws of Investing in REIT ETFs

There’s three main flaws that limit REIT ETF performance

💫 #1 ETF Flaw - ‘Reckless diversification’

Reckless diversification is the process of adding investments to one’s portfolio in such a way that its risk/return trade-off is worsened. We see many of these done by fund managers all the time. They have the mindset of picking out selected stocks or REITs to outperform the market but in the end underperform it. Also, ETFs do not pick their basket of REITs based on their current price, quality, valuation or prospects. Instead, they just own every REIT in a benchmark including the good and the bad. This means you’ve invested into an ETF or index fund which is unsustainable.

While diversification benefits still holds true, I believe (as did Charlie Munger) that applying intelligent analysis of the qualitative and quantitative aspects of each REIT can result in best total returns over the long run.

⚖ #2 ETF Flaw - Market Cap Weighted

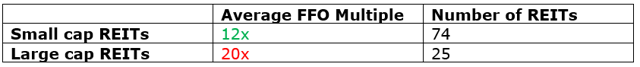

Many ETFs buy enormous positions in large-cap REITs regardless of how well the current price correlates to its underlying performance. Large-caps usually sell at a higher premium to NAV. Small-cap REITs value at a 40% discount to larger peers without any regard to actual fundamentals.

Today, large caps sell for 20x FFO multiple whiles small-caps lies at around 12X FFO. For the large-cap, this means you’re paying 20 times the price of the intrinsic value of the REIT and small-caps are just 12 times the worth of it. Higher multiples mean the REIT is too overvalued since you’re paying a premium for the actual worth of the REIT. Active investors have the great opportunity to outperform by investing in REITs with lower FFO multiples and discounted REITs, and avoiding overpriced REITs. In the long run, the market is expected to correct this mispricing, this is called value investing. My advice for you is to only invest in large-caps with higher multiples if you think the firm is projected to boost earnings in the near future which could lead to a rise in their share price.

📉 #3 ETF Flaw - Low Yield

Finally, because REITs invest heavily in overpriced large-cap REITs, they will typically pay out a very small 3% dividend yield. This is very common of large caps, but this is not acceptable to us. REITs are allowed by law to distribute about 90% of their income to shareholders as dividends so it’s suppose to provide high and consistent income. ETFs fail to achieve this goal due its huge positions in overpriced large-cap REITs.

Without total returns, many REIT investors target higher dividend yields for passive income needs. But be careful, some high dividend yields are unsustainable which may result in dividend cuts by management. Typically, a good dividend yield should be around a 6% to 8%. It is only possible for you to achieve good dividend yields if you become an active investor and sort out the REITs individually to find the best sustainable dividend REITs.

🚨 Flaws of Investing in REIT CEFs

There’s three main flaws that limit REIT ETF performance

📊 #1 CEF Flaw - ‘Closet Indexing’

This is where a fund manager claims to actively manage a fund for the purpose of outperforming the market for shareholders but, in reality, it is just closely mimicking the composition of a benchmark index. The fund is essentially behaving like an index fund while charging higher management fees. This is sad and funny at the same time because it means no outperformance, neither underperformance but it’s just sitting there mimicking the index that it was suppose to outperform. You realize it would’ve been better if you had rather invested in the index fund which is a passive approach with a lower fee. Closed ended funds are actively managed. Typically, this happens due to management fear of underperformance of the fund.

💰 #2 CEF Flaw - Management Fees

With CEFs, you may not be getting the high outperformance return portfolio you were expecting as an actively managed fund, buy you’re still paying a hefty fee for it.

A REIT ETF(USRT) has a decently low expense ratio of 0.08%, which means you will pay $8 in fees for every $10,000 in value you have within the fund.

In comparison, REIT CEFs will commonly charge 1.5%-2% per year. This difference may not look like much but it makes a massive difference in the long run. Over a 20-year period, you end up saving 40% more money if you saved this fee. Paying a high management fee is okay if the fund is capable of producing alpha-rich returns. But it raises questions when the fund is just ‘closet indexing.’

📜 #3 CEF Flaw - Doubling up on leverage

Some CEFs employ leverage in the fund as a means of enhancing returns for shareholders. While this is good and advantageous to shareholders, it also introduces additional risks when the portfolio declines in value. The losses are magnified leading to increased volatility. And for all we know, REITs are already leveraged at the company level so investing in leveraged funds adds another layer of leverage which is dangerous. It’s the equivalent of buying highly-leveraged REITs. I believe that greater total returns will be generated by focusing on REITs with conservative balance sheets and low leverage.

🗝 Bottom Line

REITs remain one of the only market sectors where active investing has proven to outperform passive approaches. Why? Because REITs remain highly misunderstood by most investors, including professionals. Many people don’t bother to understand the stock market so they choose to stick with private real estate. Some is due to human nature. As a result, REITs remain particularly inefficient with frequent mispricing to this day. Regardless, opportunities to add value and generate alpha are frequent for those who follow the active approach to invest in REITs. From a value approach, the best active REIT investors have reached up to 22% per year compared to ETFs and CEFs with only 10% per year.

REIT CEFs and ETFs are restrictive, they allow you to own those you prefer with those you don’t want.

I don’t prefer externally-managed REITs since they have historically underperformed due to conflicts of interest

I don’t prefer mortgage REITs because it has produced 0% returns over the past 15 years due to their unattractive business model

I don’t prefer all REIT property sectors like hotel, office, and retail. The issue being high capex to maintain hotel properties leading to extreme volatility, office REITs declining due to remote working and retail crushing due to ecommerce.

I don’t prefer low dividend yields of 3%-4% that most ETFs and CEFs pay. I prefer particularly 6%-8% since REITs are an income-driven investment

I don’t prefer REITs with higher FFO multiples and high premiums to their NAV

I could go on and on. The point is that there’s a lot of REITs that are overleveraged, conflicted, and overvalued. With ETFs and CEFs, you have no option. You will own all REITs included in their portfolio including those that are poised for disappointing results in the long run.

My advice I would give to you is to;

💸 Lower FFO multiples: By being selective, you can find small cap REITs selling at lower FFO multiples typically around 12X FFO. ETFs and CEFs invest in large cap REITs which can sell at an FFO of 20X - 8 notches higher than small caps. It gives you an advantage to gain more from each dollar invested.

🌟 Focus on Superior Sectors: Rather than blindly investing in REIT property sectors that are cyclical in nature like hotel and office, you can be selective in other resilient property sectors.

📉 Buy below NAV: The way to stop overpaying for REITs is to focus on the NAV. Some REITs trade at around 50% premium to NAV which I think will result in disappointing returns to the investor in the long run. You need to be selective to find REITs that are trading at a discount to NAV to have a better head start.

📈 High Yield: REITs are income-driven investments so the best dividend yield for an active investor is around 6%-8%. ETFs or CEFs pays around 2%-3% since they heavily invest in large caps.

REIT investors can greatly improve their returns by targeting undervalued individual opportunities. Nevertheless, you should be conscious of your limitations, if you know you have no access to research, do not have the expertise, the time, then you should probably stick to REIT ETFs and CEFs.

But for the rest, if you have access to good insights, have the interest to follow your positions, then you’re made to become an active investor. It’s not only a rewarding approach but very enjoyable and interesting.

I personally use Interactive Brokers for all my REIT investments. They provide access to all REIT common shares and preferred shares as well as international REIT investments with low transaction costs. I have been with them for many years and can definitely recommend them. Other people use Fidelity, E*TRADE, Charles Schwab, Robinhood and others.

If you want to open an Interactive Brokers account, you can use my referral link to get up to $1000 of free stocks. Click here

REIT's are still in their nascent stage in India. There are only about three at present and they focus on hotel and office sectors, which are affected by high maintenance and remote work, respectively, like you've rightly mentioned. It's been about 3 years and there has been no price appreciation. Hopefully more sectors will come here in the future. Great post by the way.