REITs By Property Types - Module 7 (Part 1)

Unlocking Real Estate Investing: A Guide to REITs - Module 7 (Part 1)

Greetings, fam 👋

I welcome the new additions to our community!

Glad you’re here with us!

You can find the past modules at the end of this post.

REITs basically invests in every imaginable property type that you can think of, and your sector-level decision is just important as your income security-level decision. Investors are therefore to either build a diversified portfolio or pick out individual sector REITs that they believe in. There are several property sector REITs. I’ll list them here.

🏪 Office REITs

🏭 Industrial REITs

🛒 Retail REITs

🏡 Residential REITs

🏕 Lodging/Resort REITs

🎭 Specialty REITs

🚑 Healthcare REITs

🌁 Diversified REITs

💾 Data Center REITs

📦 Self Storage REITs

🏗 Infrastructure REITs

🏛 Mortgage REITs

🌲 Timberland REITs

🌽 Farmland REITs

REITs invest in all these diverse property sectors. Some specialize in only one or two of them whiles some diversify in several of them. Take note, each sector has its own risk and return characteristics and picking the right sector at the right time is very crucial as a REIT investor.

An example, Net Lease REITs may enjoy consistent cashflow whiles Hotel REITs gets crushed during a recession.

Investing in specific sectors can literally make or break your REIT investment. Below I describe the property sectors and explain the pros and cons of each of them. I will conclude with a list of my favourite and least favourite property sectors.

REIT Property Sectors

Office REITs 🏣

Office REITs are REITs that build, manage and maintain office buildings which are then rented out to companies that need them. Office REITs are usually located around central business districts, industrial areas or suburban areas. They are mostly rented out to multinational corporations, NGOs, tech firms, banks, law firms, fintech companies, biotech firms, government firms, etc. The performance of Office REITs are influenced by various factors, including occupancy rates, rental rates, economic conditions and the overall demand for office spaces.

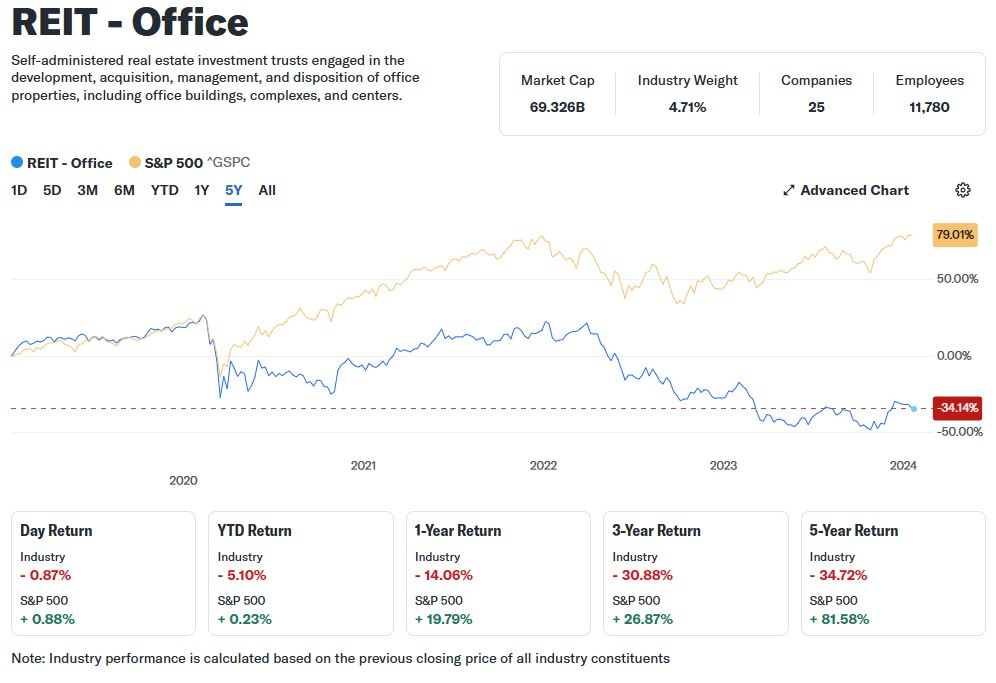

The chart above compares the performance of office REITs to the S&P 500. 1-year return and 5-year return of office REITs are -14% and -30% respectively as the S&P 500 made a whooping 79% gain during those periods.

An example, Boston Properties, a company listed on the NYSE(BXP) which deals with maintaining and owning class-A office spaces for leasing purposes. Class-A offices mean high-end offices in a developed area. Boston Properties shares have lost over 30% of their value in the past year, reflecting the poor performance of the office REIT sector. The future of remote work may continue to put pressure on the office REIT sector, high occupancy is still an issue, making office REITs unattractive in my opinion.

Industrial REITs 🏭

Industrial REITs are REITs that acquire, develop and manage industrial facilities and rent space in these properties to tenants. Industrial facilities include factories, distribution centers, warehouses, e-commerce fulfilment centers, etc. Usually, industrial properties are located outside the central business district since they require a large space for setting up machinery and loading track. Warehouses, distribution centers and fulfilment centers are also typically set up near major metropolitan areas so that they can speed up order fulfilment between when a client makes an order and when it is delivered to the customer’s doorstep.

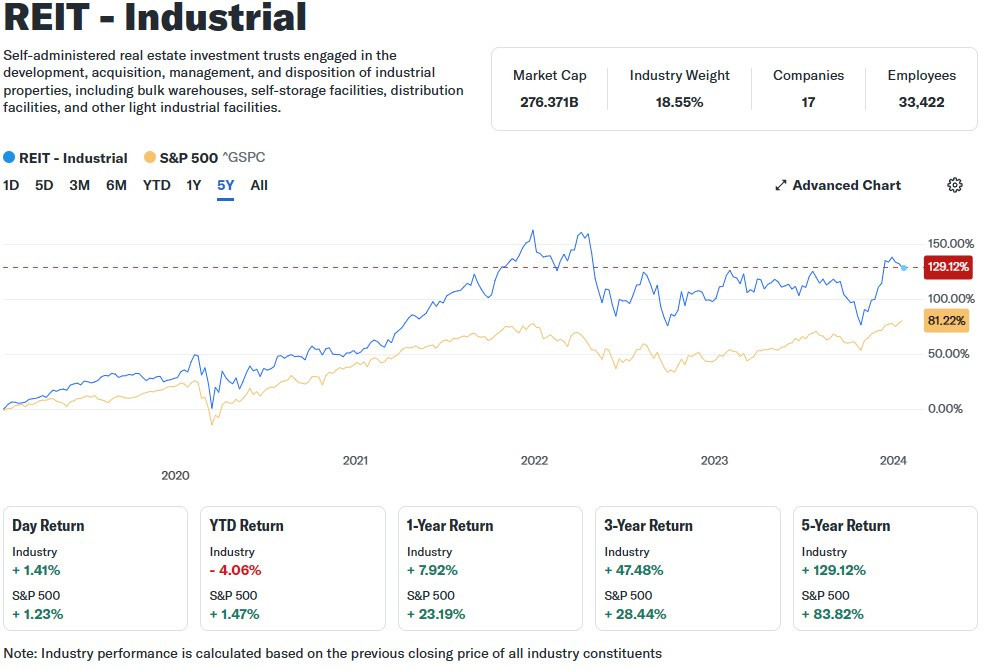

1-year return and 5-year return of industrial REITs are 7% and 126% respectively against the S&P 500 making 81% during that period.

For example, STAG Industrial, a company listed on the NYSE(STAG) focuses on the acquisition, ownership and operation of industrial properties throughout the US. STAG industrial has gained over 14% of their value over the past year, reflecting the good performance of the industrial REIT sector. The performance of industrial REITs has benefited greatly from the growth of e-commerce. These companies need warehouses and fulfilment centers to store their goods for clients who order for them. This has made industrial REITs very attractive for investors in my opinion.

Retail REITs 🛒

Retail REITs are REITs which engages in the development, acquisition, management, and disposition of retail properties, including community shopping centers, factory outlet shopping centers, strip centers, restaurants and other retail properties. Retail properties are usually located in upmarket areas and central business districts.

Under Retail REITs, mall REITs and net-lease REITs are a subtype of it. Mall REITs accommodates a high number of tenants at the same time. If one of the tenants shifts location, there will be a little effect on the revenues, and space can be filled up within a short time due to the high demand for mall space. Apart from rental income, shopping malls also make money from other services such as parking fees, swimming pools, conference halls, etc.

Net-lease REITs require their tenants to pay a monthly, quarter or annual rent plus other expenses, such as insurance, maintenance costs, and taxes. They are rented to mostly grocery stores, convenience stores, boutiques, etc.

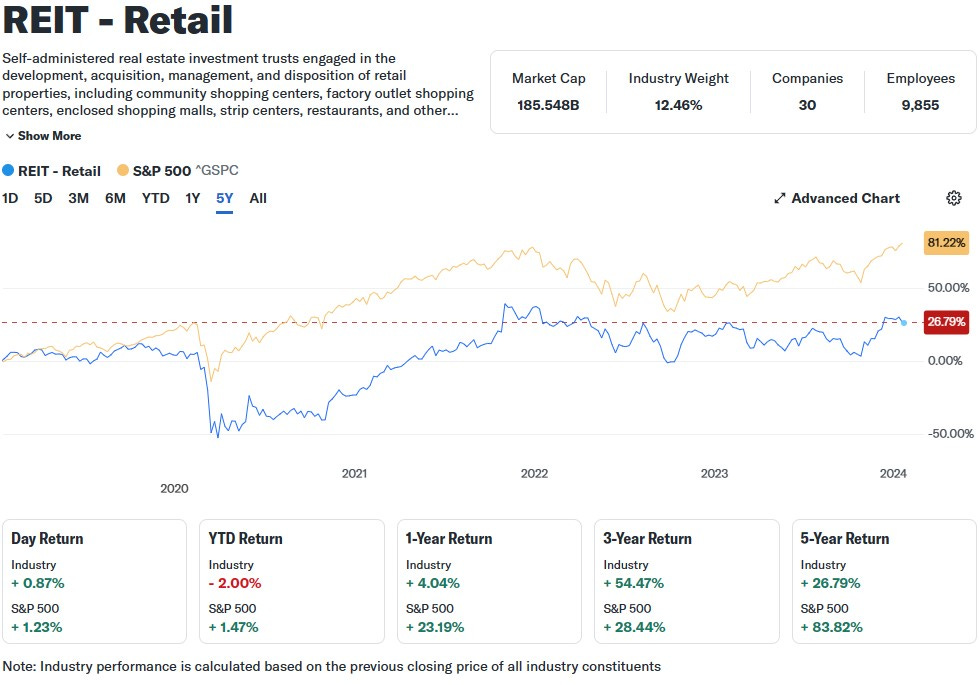

1-year return and 5-year return of retail REITs are 4% and 26% respectively whiles the S&P 500 made a huge gain of 81% during that period.

An example, Simon Properties Group (NYSE: SPG) engages in the ownership of premier shopping, dining, entertainment properties, etc. SPG have gained 17% of its value in the past year, depicting the modest gain of retail REITs after its decline. To see retail REITs perform better than the S&P 500, it will depend on various factors, that is occupancy rates, rental rates and economic conditions.

This read will be continued…

I personally use Interactive Brokers for all my REIT investments. They provide access to all REIT common shares and preferred shares as well as international REIT investments with low transaction costs. I have been with them for many years and can definitely recommend them. Other people use Fidelity, E*TRADE, Charles Schwab, Robinhood and others.

If you want to open an Interactive Brokers account, you can use my referral link to get up to $1000 of free stocks. Click here