REITs By Property Types - Module 7 (Part 2)

Unlocking Real Estate Investing: A Guide to REITs - Module 7 (Part 1)

Greetings, fam 👋

I welcome the new additions to our community!

Glad you’re here with us!

You can find the past modules at the end of this post.

This is a three-part series of REITs by Property Types, Module 7. You can go check the part 1 out through here.

REITs By Property Types - Module 7 (Part 1)

Greetings, fam 👋 I welcome the new additions to our community! Glad you’re here with us! You can find the past modules at the end of this post.

I chose to break it into a series since it would have been too long for a single reading.

To recap, the point of this module is about how to understand REITs property types individually and the performance of each of them.

So, we continue from there, the next on my list is Residential REITs

REIT Property Sectors

Residential REITs 🏡

Residential REITs are REITs that own and manage residential units for renting out to tenants. Residential REITs include REITs that specializes in apartment buildings, student housing, manufactured homes, condos, single-family housing, multi-family housing, mobile-home parks, etc. They just must be residential - not for commercial or industrial use. Residential REITs are usually located in suburban (for family housing) and metropolitan and urban areas (for apartment housing.)

For residential REITs, people will always need somewhere to live. Whether it’s your first day at college, you need to live in a student housing or posting at work to a different region, you would need an apartment, and whether you move to the suburbs, you would pick a family housing. Residential real estate is always needed as long as people need roof on their heads.

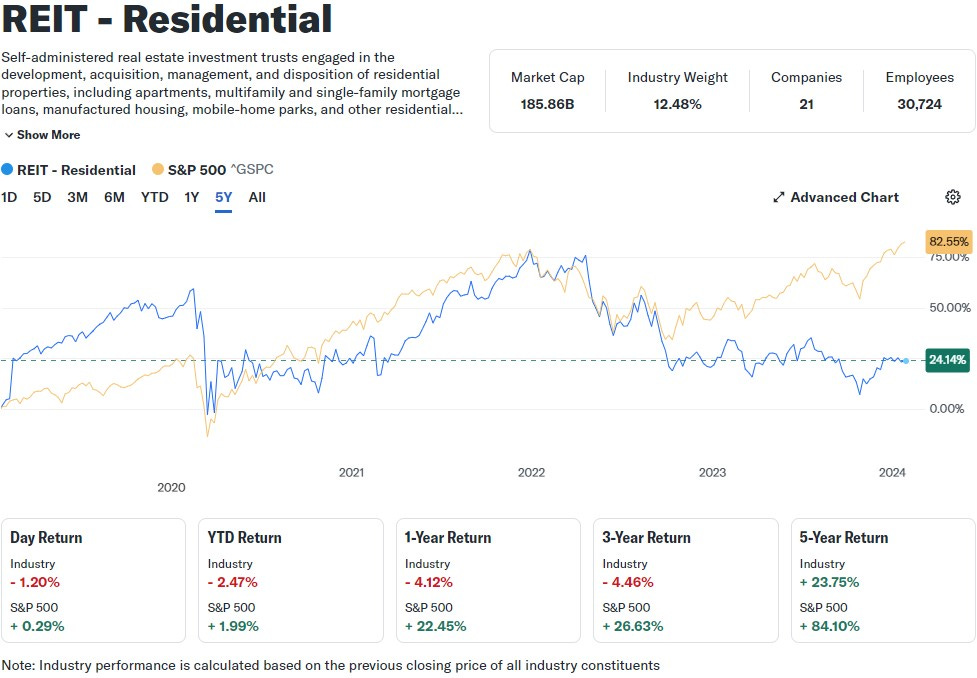

The chart above compares the performance of residential REITs to the S&P 500. 1-year return and 5-year return of residential REITs are -1% and 25% respectively as the S&P 500 made a whooping 83% gain during those periods.

Residential REITs have seen much of a downward trend in their stock prices currently. Part of the reason is that residential REITs make their profits from rentals. Nowadays, more and more people want to own. Mortgage companies try to make it easier for people to own their home. With more people becoming homeowners, there could be less need for rentals.

Healthcare REITs 🚑

Healthcare REITs are REITs that own and manage a variety of healthcare-related real estate and collect rent from those properties. Healthcare property types include senior living facilities, hospitals, medical office buildings, skilled nursing facilities, surgical centers, drug treatment centers, psychiatric facilities, etc. Healthcare properties are usually located in any part of a region. But specifically, senior living facilities are usually located in calm suburbs just to escape the bustling of the city life. Hospitals are located anywhere from metropolitan areas to urban centers. The performance of healthcare is driven by necessity. Healthcare is something that everyone will eventually need. Regardless of the economy, people will definitely not stop getting sick so healthcare facilities will be providing essential services to the population they serve.

The healthcare begun to face some headwinds during the COVID periods, partly due to inadequate personnel to manage the facilities which allowed medical facilities to raise payrates just to attract enough personnel also leading to high capital expenditure (capex). An investor investing in the S&P 500 would’ve faired a lot than holding on healthcare REIT ETFs. Nevertheless, healthcare is a necessity, so I expect investors to earn income from this sector these coming years.

Hotel REITs 🏩

Hotel REITs are REITs that own, acquire and manage hotels, motels, luxury resorts, and business-class hotels, along with leasing out of properties to guest.

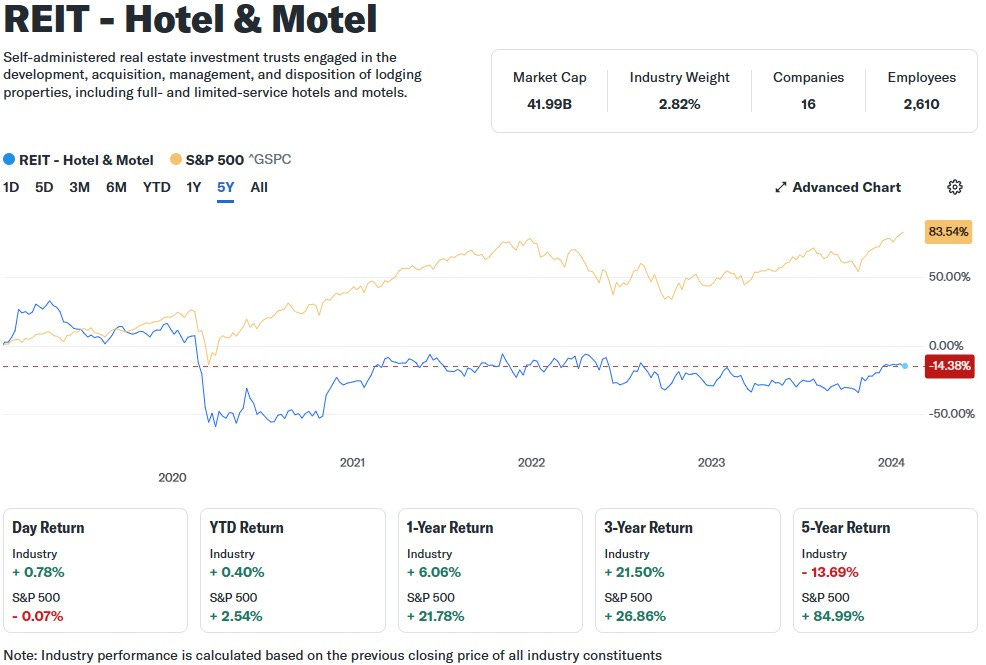

Typically, hotel REITs are very volatile which means it witnesses peak and off-peak seasons during specific periods of the year. Peak periods are detected during summer when people in large volume plan their holidays. Consequently, the hotels can earn the highest prices during the peak seasons. Also, aside from rental income, hotel REITs also offer additional services like meals, drinks, parking spaces, conference rooms, theatres, etc.

However, off-peak seasons was witnessed strongly during the pandemic when people were forced to stay indoors even during the holiday seasons leading to a sharp decline in the share prices of hotel REITs. Hotel REITs are catered for investors who want to invest in commercial properties and have the ability to absorb the risk and volatility of the hotel sector so it is better to diversify in such sectors.

Mortgage REITs 🏛

Mortgage REITs are REITs that engages in the acquisition, management, and disposition of mortgage-backed securities. They finance real estate properties through the purchase of mortgage or mortgage-backed securities and earn interest from these investments when their principal is paid back by the mortgage borrower.

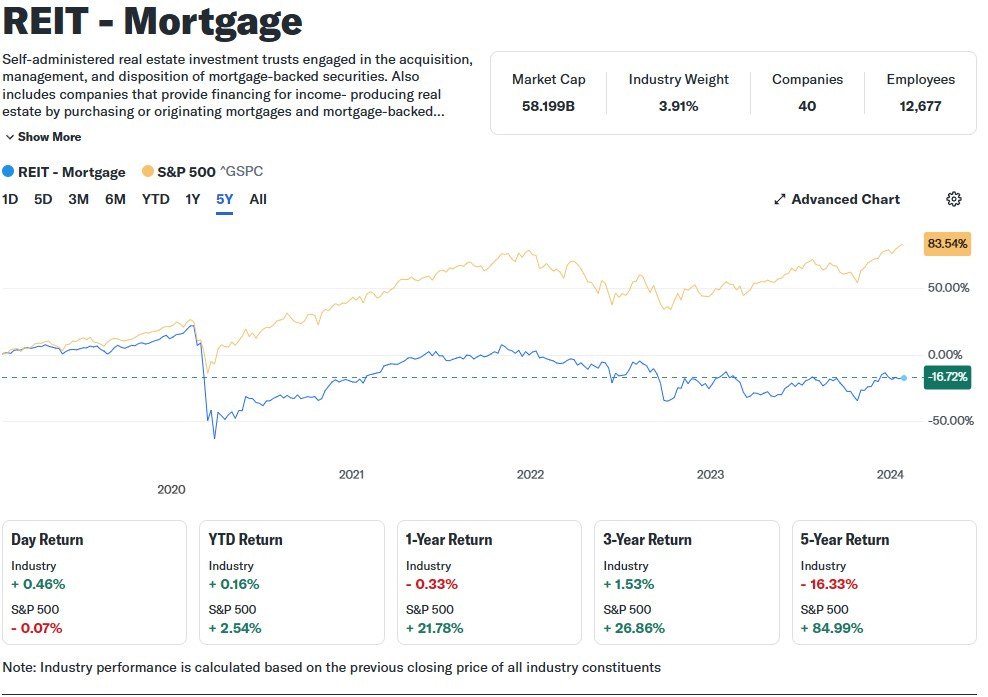

Mortgage REITs are a good investment due to the high dividend yields it pays. However, the only issue on mortgage REITs is that it is sensitive to interest rates. The business model of mortgage REITs is similar to a ‘bank’ than a property investment. They earn profits from their principal, when it is offered to a borrower at a specific rate and earn the spread between their principal and interest.

Anyways, interest rate makes them unsustainable for the long term. We all know what happened to Silicon Valley Bank a year ago due to their allocation of capital into interest-sensitive investments (bonds).

But as the Federal Reserve increased interest rates in response to high inflation, Silicon Valley Bank’s bonds became riskier investments. Because investors could buy bonds at higher interest rates, Silicon Valley Bank’s bonds declined in value. ~Investopedia

This read will be continued…

I personally use Interactive Brokers for all my REIT investments. They provide access to all REIT common shares and preferred shares as well as international REIT investments with low transaction costs. I have been with them for many years and can definitely recommend them. Other people use Fidelity, E*TRADE, Charles Schwab, Robinhood and others.

If you want to open an Interactive Brokers account, you can use my referral link to get up to $1000 of free stocks. Click here